What’s Next After Major MLB Signings and Trades: Team Fit, Market Ripples, and the Offseason Ahead

Why “what’s next?” is the question that follows every major move

When a free agent signs a new deal or a big-name player gets traded, the immediate reaction is often excitement, frustration, or surprise. But the more lasting impact is strategic: what the move changes for the player’s new club, for the team that just lost him, and for the rest of the market. A single signing can reset expectations at a position, shift a team’s priorities toward another need, or even alter how other players are valued in negotiations.

This offseason has already produced a series of notable deals that touch nearly every part of roster building: starting pitching, late-inning relief, infield depth, and even the trade calculus around veterans and prospects. Below is a look at several headline moves and the practical questions they raise for the teams involved.

Rotation decisions: durability, cost, and contingency planning

Starting pitching remains one of the clearest places where a single transaction can change a team’s outlook. In one case, San Diego addressed a rotation issue by reportedly re-signing Michael King to a three-year, $75 million deal that includes opt outs after each of the first two seasons. The context matters: the Padres had already lost Dylan Cease to the Blue Jays in free agency, so keeping King prevents a second major rotation departure and stabilizes a group that “needed to be addressed.” The opt-outs also introduce an ongoing decision point—King’s performance over the first two seasons could quickly reshape the club’s future plans.

Cease’s own market-setting deal underscores how teams weigh durability against long-term risk. Described as the top starting pitcher on the market this winter, Cease has eclipsed 200 strikeouts and made at least 32 starts in each of the past five seasons—an uncommon level of reliability. The question, however, is whether that track record justifies a massive seven-year, $210 million contract that runs through his age-36 season. For the Blue Jays, the signing signals a willingness to pay for stability at the top of the rotation. For other teams and pitchers, it becomes a reference point in negotiations.

Chicago also paid a steep price to strengthen its pitching staff, acquiring Edward Cabrera from Miami. The Cubs sent a package including three prospects, headlined by outfielder Owen Caissie. That type of prospect cost can have ripple effects: it not only reflects how much the Cubs valued rotation help, but it also changes how they might approach future trades, given that prospect depth has been partially spent.

Lineup fit and injury timelines: solving immediate needs without closing future doors

Some moves are driven by short-term lineup gaps created by injury. Willson Contreras, for example, is framed as an ideal fit for a Red Sox lineup that needed help at first base while Triston Casas continues rehabbing from a ruptured patellar tendon. The fit is practical: it addresses a current hole while Casas works back. At the same time, the deal has a second layer—St. Louis continues to focus on adding controllable starting pitching, and the return they received for Contreras “certainly accomplishes that.” In other words, one team solves an immediate offensive and positional problem, while the other advances a longer-term roster objective.

In Detroit, health also sits at the center of the decision-making. After hernia surgery, Gleyber Torres expected to be ready for spring training. The Tigers’ willingness to make him the second-highest paid player for the upcoming season—behind All-Star slugger Javier Báez—suggests confidence in his recovery. It also frames a broader question for Detroit: how the club balances near-term roster upgrades with other major priorities, including what comes next for the team and key players.

The bullpen market: premium value, defined roles, and late-inning dominoes

Relief pitching continues to command attention and, in some cases, record-setting terms. Edwin Díaz agreed to a three-year, $69 million deal with the Dodgers, and the contract reportedly carries the highest average annual value ever for a reliever. The structure matters: Los Angeles filled what was described as its most obvious need and did so without offering a fourth or fifth year. That approach highlights how elite relievers can earn top-of-market annual salaries even when teams remain cautious about long-term length.

Role definition is just as important as dollars. Robert Suarez led the National League with 40 saves last season and has a major league-leading 76 saves over the last two years with the Padres. Yet it “sounds like” he will serve in a setup role in front of Iglesias in 2026. With Iglesias returning on a one-year deal, there is also a plausible path for Suarez to transition back to the closer role for the final two years of his deal. For teams, this is a reminder that bullpen construction is not only about acquiring talent—it is about sequencing, contract timelines, and flexibility from year to year.

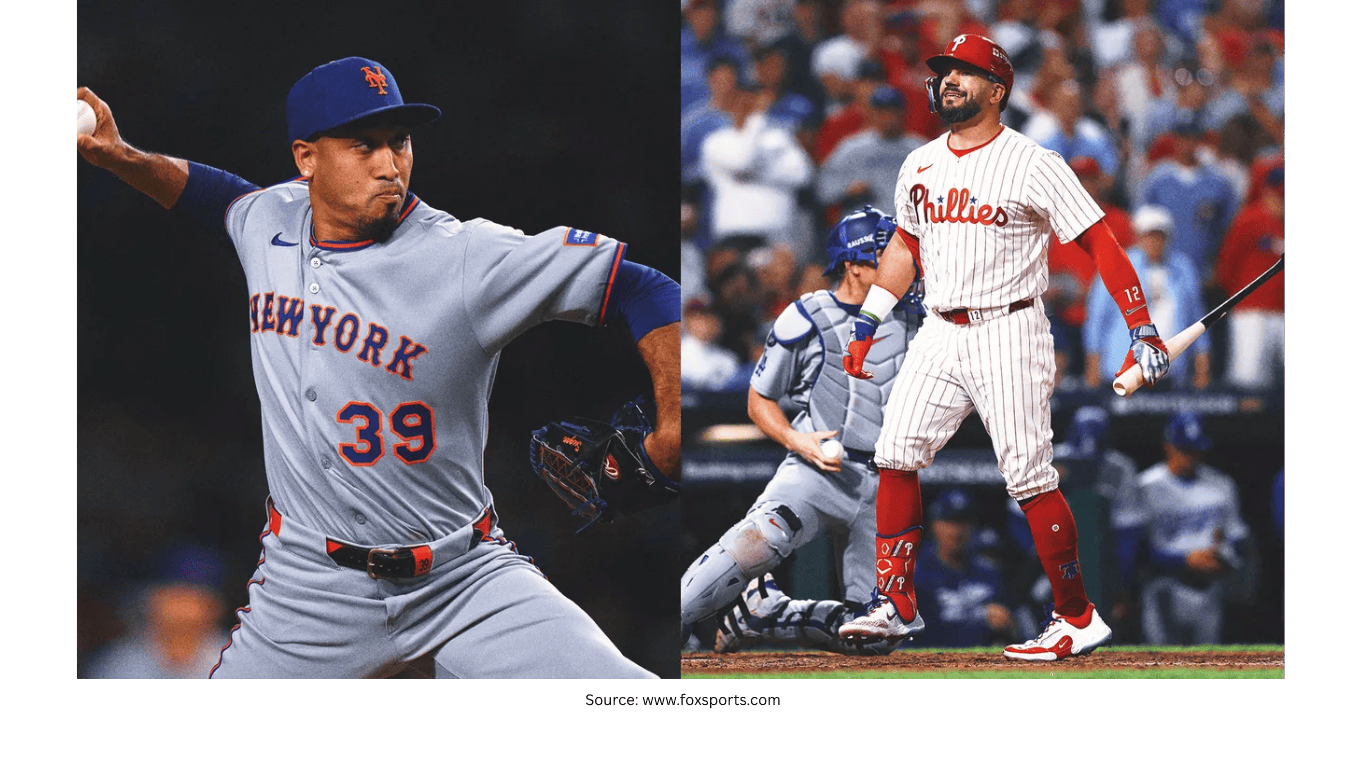

Meanwhile, reliever Devin Williams brings a different kind of evaluation challenge. A former Rookie of the Year and two-time National League Reliever of the Year, Williams had a rocky season with the Yankees, though his strikeout rate remained elite. The Mets are described as aiming to correct both of those departments while also trying to retain All-Star closer Edwin Díaz—an example of how one bullpen decision can influence another, particularly when elite late-inning arms are involved.

Trades that reshape identity: leadership, defense, and clubhouse impact

Not every move is about plugging a statistical hole. Sometimes it changes the feel of a team. Brandon Nimmo, the longest-tenured Met, agreed to waive his no-trade clause, allowing New York to send him to Texas in exchange for veteran All-Star infielder Marcus Semien. The deal removed a clubhouse leader and fan favorite from New York, but it also added a defensive upgrade with a championship pedigree at second base. That is a classic trade-off: leadership and familiarity out, a different kind of stability and defensive value in.

In Philadelphia, continuity was the theme. Re-signing Kyle Schwarber was described as the team’s top priority, and the importance was framed as both competitive and cultural. It would have been difficult to map out a pivot had he signed elsewhere, “both in terms of talent and significance to the fan base.” That kind of statement illustrates why some decisions are treated as foundational, even before the rest of the roster is finalized.

Roster depth and market positioning: center field and beyond

Some contracts are as much about insurance as they are about everyday roles. Trent Grisham’s return on a one-year, $22 million deal suggests the Yankees are not confident their prospects are ready to become everyday major-league contributors. It also gives the team a “parachute” if it does not sign a top free-agent outfielder. Moves like this can quietly influence the rest of free agency by reducing urgency—or by signaling that a team is still shopping, just with more leverage.

Seattle’s outlook after acquiring Josh Naylor also highlights how teams value decision-making and versatility. Mariners general manager Justin Hollander described Naylor as one of the smartest players he has ever had, pointing to Naylor’s perfect 19-for-19 stolen base record in Seattle as an example. Despite being one of MLB’s slowest players, Naylor produced a 20-30 season despite never having stolen more than 10 bases in a season, a result attributed to baseball IQ. The next step becomes how Seattle builds around that kind of player profile and what additional moves best complement it.

High-risk, high-reward profiles: projecting fit and position

Not every free agent is valued for certainty. One intriguing Japanese star was viewed as a high-risk, high-reward option due to a high whiff rate and limited defensive range at third base—traits that may necessitate a full-time move to first base or designated hitter. For teams considering that player type, “what’s next” often centers on role clarity: where the bat plays best, how much defensive compromise is acceptable, and what the roster must look like to support the fit.

What these moves collectively signal about the rest of the offseason

Premium pitching remains expensive, whether through long-term starter contracts or record-setting reliever average annual value.

Teams are balancing present needs with flexibility, using opt-outs, shorter terms, and role-based bullpen planning to avoid being locked in.

Trades continue to blend talent with identity, swapping leadership and familiarity for defense, controllable pitching, or roster reorientation.

Depth signings can be strategic leverage, especially when a club wants protection at a position while keeping options open in free agency.

As more deals arrive, the central question will stay the same: not only who improved, but how each move changes the next decision—on the field, in the clubhouse, and across the market.